how to calculate nh property tax

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000. Tax amount varies by county.

Property Tax Rates 2009 Vs 2020 R Newhampshire

New Hampshires tax year runs from April 1 through March 31.

. New Hampshire income tax calculator. For comparison the median home value in New Hampshire is 24970000. Friday 8 AM 1 PM.

By Porcupine Real Estate Oct 4 2017 Real Estate. Are all made available to enhance your understanding of New Hampshires property tax system. New Hampshires real estate transfer tax is very straightforward.

The buyer cant deduct this. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15.

This manual was the result of a collaboration of dedicated professionals who volunteered their time and knowledge in the hope of shedding light on how the property tax works. State Education Property Tax Warrant. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

New Hampshires median income is 73159 per year so the median. If the Tax Lien remains unpaid for two years it. With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in property taxes.

Learn how much New Hampshire homeowners pay along with information about New Hampshire property tax rates deadline dates exemptions and how to appeal. New Hampshire property taxes. Understanding Property Taxes in New Hampshire.

On average homeowners in New. So if your rate is 5 then the monthly rate will look like this. 1 Junkins Avenue Portsmouth NH 03801.

We genuinely invite commentary from the public. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes.

Hours Monday 8 AM 6 PM. This is followed by Berlin with the second highest property tax rate in New Hampshire with a property tax rate of 3654 followed by Gorham with a property tax rate of 356. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20.

The outcome is the same when the market value of the properties increases above the assessed value in this case to 275000. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. Although the Department makes every effort to ensure the accuracy of data and information.

The result is the tax bill for the year. New Hampshire has no income tax on wages though the state does charge a 5 tax on income from interest and dividends. In Claremont for example the property tax rate is 41 per 1000 of assessed value while in Auburn its only around 21 per 1000 of assessed value.

Estimate your tax refund. More About This Page. Heres how to find that.

Enter your Assessed Property Value Calculate Tax. 300000 1000 300 x 2306 6910 tax bill 1. Thoroughly calculate your actual real property tax including any exemptions that you are qualified to utilize.

The TaxProper guide to New Hampshire property taxes. The local tax rate where the property is situated. Learn More About New Hampshire Withholding.

The average effective property tax rate in strafford county is 242. New Hampshire Property Tax. Property tax rates vary widely across New Hampshire which can be confusing to house hunters.

Overview of New Hampshire Taxes. This calculator is based upon the State of New Hampshires Department of Revenue. Paycheck Calculators by State.

The assessed value of the property. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. How to Calculate Your NH Property Tax Bill.

The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed value. Tuesday Thursday 8 AM 430 PM. You can use the above formula to calculate the daily interest charge for the Tax Lien.

N the number of payments over the life of the loan. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. Divide the total transfer tax by two.

This is your manual. The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax. If you take out a 30-year fixed rate mortgage this.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year.

New Hampshire Property Tax Calculator Smartasset

2020 Tax Rate Set Town Of Nottingham Nh

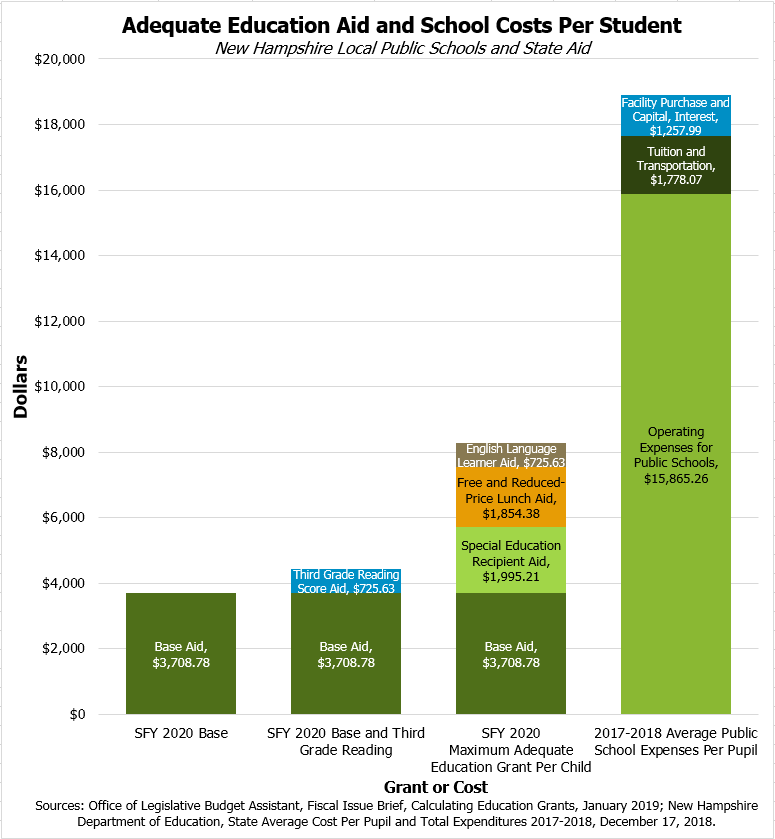

Held Back Why N H Still Struggles To Answer School Funding Questions New Hampshire Public Radio

How To Convert A Mill Rate To Taxes

New Hampshire Property Tax Calculator Smartasset

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

New Hampshire Income Tax Calculator Smartasset

How To Calculate Property Tax And How To Estimate Property Taxes

Education Funding In The House Budget New Hampshire Fiscal Policy Institute

2021 Tax Rate Set Town Of Nottingham Nh

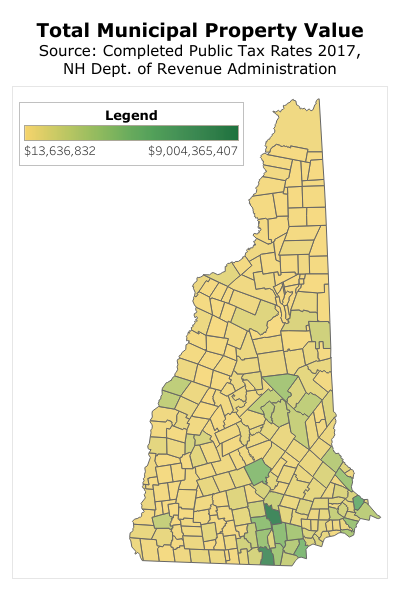

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

How To Calculate Transfer Tax In Nh

2021 Tax Rate Set Hopkinton Nh

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

Dmv Fees By State Usa Manual Car Registration Calculator

New Hampshire Estate Tax Everything You Need To Know Smartasset

Held Back Why N H Still Struggles To Answer School Funding Questions New Hampshire Public Radio

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)